Corporate Tax

A rising number of organizations are embracing bookkeeping reevaluating as an essential answer for enhance their monetary tasks. This training includes entrusting Corporate Tax to an outsider specialist co-op, conveying a huge number of benefits to organizations, everything being equal.

Corporate Tax Consultants in Dubai

Are you ready for UAE Corporate Tax?

Registration for Corporate Tax in UAE has been started.As firms must be registered for corporation tax, hiring the best corporate tax consultants in Dubai, UAE for tax consultancy services has become imperative.

Corporate Tax Firm in Dubai,UAE

Get ready to navigate the intricacies of the Corporate Tax regulations issued by the Ministry of Finance (MoF), ensuring compliance while maximizing your potential for success. Let’s dive into the exciting details!

Scope of Applicability

Attention, individuals and legal persons! If you’re engaged in business activities under a commercial license in the UAE, the Corporate Tax awaits your arrival. But fear not, exceptions exist to maintain the balance:

- Entities involved in extracting natural resources remain subject to Emirate-level corporate taxation, aligning with the essence of their operations.

- Entities operating within free zones bask in the glory of tax incentives, as long as they abide by regulations and refrain from conducting business with mainland UAE.

Exemptions Behind the UAE Corporate Tax Realm

In the UAE Corporate Assessment world, certain exclusions give alleviation and clearness to organizations working inside its ward. In particular, two critical prohibitions merit consideration: capital additions and profits acquired from qualifying shareholdings, and qualifying intra-bunch exchanges and restructurings.

Capital additions and profits, right off the bat, got from qualifying shareholdings are absolved from the UAE Corporate Assessment. This exclusion guarantees that organizations and people can partake in the monetary advantages emerging from their interests in shares, without causing extra taxation rates. Such qualifying shareholdings allude to ventures that meet the particular measures framed by the assessment guidelines.

Furthermore, qualifying intra-bunch exchanges and restructurings are likewise absolved from the UAE Corporate Assessment. This exclusion recognizes the special idea of exchanges and restructurings that happen inside a gathering of organizations. It perceives that these inward trades and changes are normally executed for vital or functional purposes, as opposed to produce available pay. By absolving these exchanges, the expense system empowers smooth activities and effectiveness inside corporate gatherings.

These exceptions expect to find some kind of harmony between advancing venture, working with business exercises, and guaranteeing a fair and economical duty climate. Along these lines, the UAE Corporate Expense framework looks to boost financial development and encourage a positive business environment for both homegrown and worldwide substances working inside the UAE.

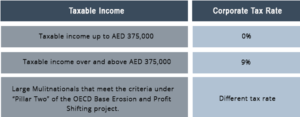

Corporate Tax Rates

Safeguarded and Supported: BAM Advisors at Your Side

At ATA Advisors in Trade Center, Dubai, we stand as your steadfast companions, we stand as your steadfast companions, guiding you through the labyrinth of Corporate Tax. Our array of services includes:

- Ensuring your books of accounts align with International Financial Reporting Standards (IFRS), laying a strong foundation for your tax journey.

- Adhering to forthcoming corporate tax guidance, we navigate the complexities to keep you on course.

- We assist in the preparation and filing of corporate tax returns, ensuring compliance with the authority’s requirements.

- Our expert advisors provide insights into the corporate tax amounts to be paid, ensuring you follow the guidelines issued.

- We streamline the process, assisting with the timely filing of corporate tax returns.

- Regular health checks ensure your adherence to Corporate Tax guidelines, protecting your business from any potential pitfalls.

The fate of tax assessment has shown up, and ATA Consultants stands prepared to open your true capacity inside this new scene. Embrace the change, outfit yourself with information, and leave on the Corporate Duty experience with certainty and achievement. Together, how about we explore the way forward!

Don’t bother looking any further! The master group at Marketplace Bookkeeping and The executives Counsels in DWTC gives a thorough rundown of monetary administrations so you can zero in on your center business.